| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

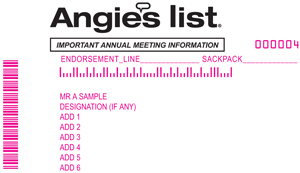

ANGIE’SANGIE’S LIST, INC.

1030 E. Washington Street

Indianapolis, Indiana 46202

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS TO BE HELD ON MAY 7, 201313, 2014

To the Stockholders of Angie’s List, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (“Annual Meeting”) of Angie’s List, Inc., a Delaware corporation (the “Company”), will be held on Tuesday, May 7, 2013,13, 2014, at 10:00 a.m. local time, at The Columbia Club, 120121 Monument Circle, Indianapolis, Indiana, 4620246204 for the following purposes:

1. | To elect |

2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year; |

3. | To approve, by non-binding advisory vote, the compensation of our named executive officers; and |

4. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Our Board of Directors has fixed the close of business on March 12, 201314, 2014 as the record date for determination of stockholders entitled to notice of, and to vote at, the annual meeting and any postponements or adjournments of the meeting.

Our Board of Directors recommends that you voteFOR the election of the director nominees named in Proposal No. 1 of the Proxy Statement,FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current year as described in Proposal No. 2 of the Proxy Statement, andFOR the approval, on an advisory basis, of the compensation of our named executive officers as described in Proposal No. 3 of the Proxy Statement.

You are cordially invited to attend the Annual Meeting, but whether or not you expect to attend in person, we urge you to mark, date, and sign your proxy card, and promptly return it by mail or follow the alternative voting procedures described in the proxy materials or the proxy card. If you attend the meeting, you may vote your shares in person, which will revoke any prior vote.

By Order of the Board of Directors |

/ |

Shannon M. Shaw Executive Vice President, General Counsel & Corporate Secretary |

Indianapolis, Indiana

March 28, 2013

PAGE | |||

| 9 | |||||

INFORMATION REGARDING THE BOARD OF DIRECTORS AND ITS COMMITTEES | 11 | ||||

11 | |||||

11 | |||||

11 | |||||

12 | |||||

14 | |||||

14 | |||||

14 | |||||

14 | |||||

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 15 | ||||

17 | |||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 18 | ||||

21 | |||||

22 | |||||

23 | |||||

23 | |||||

28 | |||||

| 30 | |||||

31 | |||||

| 32 | |||||

32 | |||||

32 | |||||

32 | |||||

34 | |||||

34 | |||||

34

i

35 | |||||

36 | |||||

36 | |||||

37 | |||||

37 | |||||

ii

ANGIE’S ANGIE’SLIST, INC.

1030 E. Washington Street

Indianapolis, Indiana 46202

FOR THE 20132014 ANNUAL MEETING OF STOCKHOLDERS

May 7, 201313, 2014

The Board of Directors of Angie’s List, Inc. is soliciting your proxy to vote at the Annual Meeting of Stockholders to be held on May 7, 2013,13, 2014, at 10:00 a.m., local time, and any adjournment or postponement of that meeting (the “Annual Meeting”). The Annual Meeting will be held at The Columbia Club, 120121 Monument Circle, Indianapolis, Indiana, 46202.46204. We intend to mail this Proxy Statement and the accompanying Proxy Card, Notice of Meeting and Annual Report to Stockholders on or about March 28, 2013,27, 2014, to stockholders of record at the close of business on March 12, 201314, 2014 (the “Record Date”). The only voting securities of Angie’s List are shares of common stock, $0.001 par value per share (the “common stock”), of which there were 58,021,54658,508,677 shares outstanding as of the Record Date (excluding any treasury shares). We need the holders of a majority of the shares outstanding of common stock entitled to vote, present in person or represented by proxy, to hold the Annual Meeting.

In this Proxy Statement, we refer to Angie’s List, Inc. as the “Company,” “Angie’s List,” “we” or “us” and the Board of Directors as the “Board.” When we refer to Angie’s List’s fiscal year, we mean the twelve-month period ending December 31 of the stated year.

The Company’s Annual Report to Stockholders, which contains consolidated financial statements for the year ended December 31, 20122013 (“fiscal 2012”2013”), accompanies this Proxy Statement. You also may obtain a copy of the Company’s Annual Report on Form 10-K for fiscal 20122013 that was filed with the Securities and Exchange Commission (the “SEC”), without charge, by writing to our Investor Relations department at the above address. The Company’s Annual Report on Form 10-K is also available on our “Investor Relations” website atinvestor.angieslist.com.

THE PROXY PROCESSAND STOCKHOLDER VOTING QUESTIONS AND

ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

WhatWhat is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act on the matters outlined in the Notice of Annual Meeting on the cover page of this Proxy Statement, namely,

the election of four Class II directors to serve until our 2016 annual meeting of stockholders or until their respective successors are duly elected and qualified;

• | the election of three Class III directors to serve until our 2017 annual meeting of stockholders or until their respective successors are duly elected and qualified; |

the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year;

• | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year; |

the approval, by non-binding advisory vote, of the compensation of our named executive officers; and

• | the approval, by non-binding advisory vote, of the compensation of our named executive officers; and |

• | any other matters that may properly be presented at the annual meeting. |

any other matters that may properly be presented at the annual meeting.

WhoWho can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 12, 201314, 2014 will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 58,021,54658,508,677 shares of common stock outstanding and entitled to vote (excluding any treasury shares).

Stockholder of Record: Shares Registered in Your Name

If, at the close of business on March 12, 2013,14, 2014, your shares were registered directly in your name with Angie’s List’s transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, at the close of business on March 12, 2013,14, 2014, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name”name,” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request, complete and deliver the proper documentation provided by your broker, bank or other holder of record and bring it with you to the meeting.

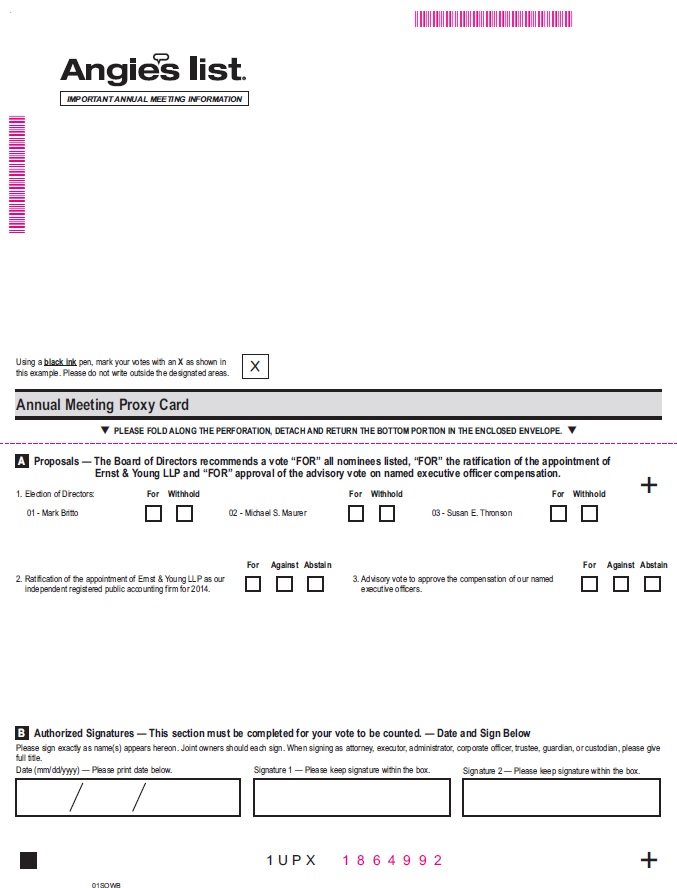

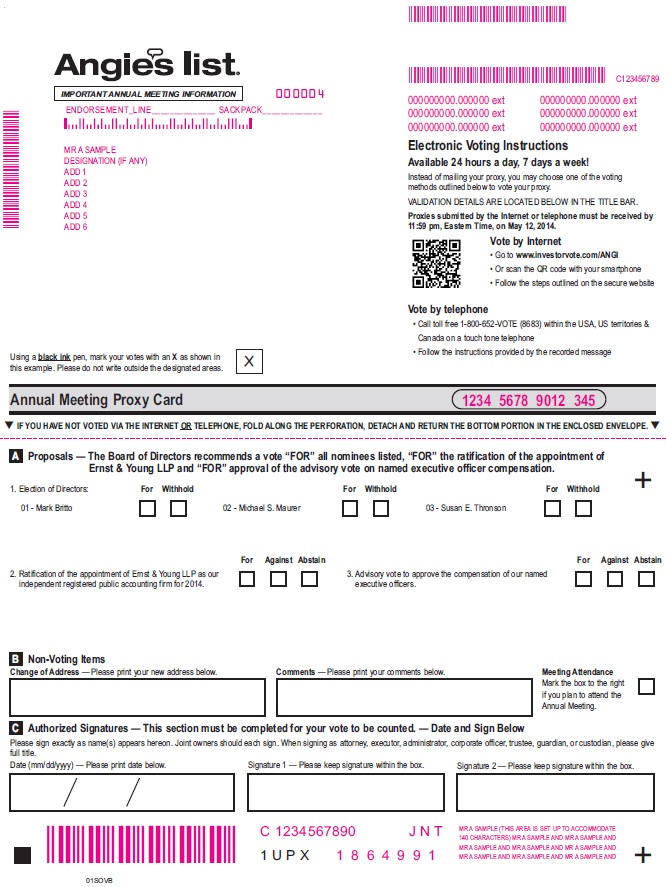

For the election of directors, you may either vote “For” the fourthree nominees or you may “Withhold” your vote for any nominee you specify. For the ratification of the appointment of our independent auditors and the advisory vote on executive compensation, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting. Alternatively, you may vote by proxy by using the accompanying proxy card, over the Internet or by telephone. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you have submitted a proxy before the Annual Meeting, you may still attend the Annual Meeting and vote in person. In such case, your previously submitted proxy will be disregarded.

To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive.

• | To vote in person, come to the Annual Meeting, and we will give you a ballot when you arrive. |

To vote using the proxy card, simply complete, sign and date the accompanying proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

• | To vote using the proxy card, simply complete, sign and date the accompanying proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

To vote by proxy over the Internet, follow the instructions provided on the proxy card.

• | To vote by proxy over the Internet, follow the instructions provided on the proxy card. |

• | To vote by telephone, follow the instructions provided on the proxy card. |

To vote by telephone, follow the instructions provided on the proxy card.

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction card to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

CanCan I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the proxy is exercised at the Annual Meeting.

Stockholder of Record. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

• | You may submit another properly completed proxy (by Internet, telephone or mail) with a later date. |

• | You may send a written notice that you are revoking your proxy to Angie’s List’s Corporate Secretary at 1030 E. Washington Street, Indianapolis, Indiana 46202. |

You may send a written notice that you are revoking your proxy to Angie’s List’s Corporate Secretary at 1030 E. Washington Street, Indianapolis, Indiana 46202.

• | You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy.

Beneficial Owner. If your shares are held by your broker, bank or other agent, you should follow the instructions provided by them.

WhatWhat are the recommendations of the Board?

Our Board recommends that you vote:

“FOR” the election of the fourthree Class IIIII director nominees;

“FOR” ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013;2014;

“FOR” approval of the compensation of the named executive officers.

WhatWhat if I return a proxy card but do not make specific choices?

Stockholder of Record. If you are a stockholder of record and you indicate that you wish to vote as recommended by our Board, or you return a signed proxy card but do not specify how you wish to vote, then your shares will be voted “FOR” all of the director nominees and “FOR” Proposals Nos. 2 and 3. If you indicate a choice with respect to any matter to be acted upon on your proxy card, your shares will be voted in accordance with your instructions on such matter.

Beneficial Owner. If you are a beneficial owner of Angie’s List shares held in street name and do not provide the organization that holds your shares with voting instructions, your broker or other nominee may vote your shares only on those proposals on which it has discretion to vote; if your broker or nominee does not have discretion to vote, your returned proxy will be considered a “broker non-vote.” Broker non-votes will be considered as represented for purposes of determining a quorum but are not counted for purposes of determining the number of votes cast with respect to a particular proposal. Your broker or nominee does not have discretion to vote your shares on the non-routine matters such as the election of directors and advisory votes on the compensation of our named executive officers (Proposals Nos. 1 and 3). However, we believe your broker or nominee does have discretion to vote your shares on routine matters such as Proposal 2.

HowHow are abstentions and broker non-votes treated?

With respect to Proposal No. 1, the election of directors, directors are elected by a plurality of the votes of the shares present in person or by proxy and entitled to vote on the election of directors. This means that the fourthree directors receiving the highest number of votes will be elected. With respect to Proposals Nos. 2 and 3, the affirmative vote of the holders of a majority in voting power of the shares of common stock which are present in person or by proxy and entitled to vote on each proposal is required for approval.

In accordance with Delaware law, only votes cast “for”“For” a matter constitute affirmative votes. A properly executed proxy marked “abstain” with respect to any matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. If stockholders abstain from voting, including brokers holding their clients’ shares of record who cause abstentions to be recorded, these shares will be considered present and entitled to vote at the Annual Meeting and will be counted towards determining whether or not a quorum is present. Abstentions will have no effect with regard to Proposal No. 1, becauseas approval of a percentage of shares present or outstanding is not required for this proposal, and with regard to Proposals Nos. 2 and 3, will have the same effect as an “Against” vote.

If your shares are held by a broker on your behalf (that is, in “street name”), and you do not instruct the broker as to how to vote these shares on Proposals 1Nos.1 or 3, the broker may not exercise discretion to vote for or against those proposals. This would be a “broker non-vote”non-vote,” and these shares will not be counted as having been voted on the applicable proposal. However, “broker non-votes” will be considered present and entitled to vote at the Annual Meeting and will be counted towards determining whether or not a quorum is present.present and, with regard to Proposals Nos. 2 and 3, whether those Proposals are approved. With respect to Proposal No. 2, the broker may exercise its discretion to vote for or against that proposal in the absence of your instruction.Please instruct your bank or broker so your vote can be counted.

WhatWhat is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority of the outstanding shares of common stock entitled to vote are present in person or represented by proxy at the Annual Meeting. On the Record Date, there were 58,021,54658,508,677 shares issued and outstanding and entitled to vote. Accordingly, at least 29,010,77429,254,339 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you properly cast your vote in person at the meeting, electronically or telephonically, or a proxy card has beenis properly submitted by you or on your behalf. Votes “for”“For,” “Withhold” and “against,“Against,” and proxies received but marked as “abstentions” and “broker non-votes”non-votes,” will each be counted as present for purposes of determining the presence of a quorum. If there is no quorum, either the chairperson of the Annual Meeting or a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present in person or represented by proxy, may adjourn the Annual Meeting to another time or place.

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

Computershare, Inc. (“Computershare”) has beenis engaged as our independent agent to tabulate stockholder votes. If you are a stockholder of record, your executed proxy card is returned directly to Computershare for tabulation. As noted above, if you hold your shares through a broker, bank or other agent, that organization returns one proxy card to Broadridge Financial Services, Inc. (“Broadridge”) or directly to Computershare, if there is no affiliation with Broadridge, on behalf of all its clients.

WhoWho is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

We hired Morrow & Co., LLC, 470 West Avenue, Stanford, CT 06902 to help us distribute and solicit proxies. We expect to pay Morrow & Co., LLC a fee of approximately $10,000 for these services, and we will reimburse certain out-of-pocket expenses.WhatWhat does it mean if I receive more than one set of materials?

If you receive more than one set of materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must either sign and return all of the proxy cards or follow the instructions for any alternative voting procedure on each of the proxy cards you receive.

WhenWhen are stockholder proposals due for next year’s Annual Meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by November 28, 2013,27, 2014 to Angie’s List’s Secretary at 1030 E. Washington Street, Indianapolis, Indiana 46202. If you wish to submit a proposal that is not to be included in next year’s proxy materials pursuant to the SEC’s shareholder proposal procedures or to nominate a director, you must do so between January 7, 201413, 2015 and February 6, 2014;12, 2015; provided that if the date of the annual meeting is earlier than April 7, 201413, 2015 or later than July 16, 2014,22, 2015, you must give notice no earlier than 120 days prior to such annual meeting date and no later than the later of 70 days prior to the date of the meeting or the 10th day following the day on which public announcement of the annual meeting date is first made by Angie’s List. You are also advised to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

HowHow can I find out the results of the voting at the Annual Meeting?

Voting results will be announced by the filing of a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING,

PLEASE VOTE AS SOON AS POSSIBLE.

ELECTION OF DIRECTORS

The Company’s Amended and Restated Certificate of Incorporation currently provides for a Board of Directors divided into three classes, designated Class I, Class II and Class III.

The Board currently consists of ten directors, divided into the following three classes:

• | Class III directors: Mark Britto, Michael S. Maurer and Susan E. Thronson, whose current terms will expire at the annual meeting of stockholders to be held this May. |

• | Class I directors: John H. Chuang, Roger H. Lee and William S. Oesterle, whose current terms will expire at the 2015 annual meeting of stockholders; |

• | Class II directors: John W. Biddinger, Angela R. Hicks Bowman, Steven M. Kapner and Keith J. Krach, whose current terms will expire at the 2016 annual meeting of |

The three Class III |

The four Class II directorships are up for election at the 20132014 annual meeting of stockholders. Messrs. Biddinger, KapnerBritto and KrachMaurer and Ms. Hicks BowmanThronson have been nominated to serve as Class IIIII directors and have each elected to stand for reelection. Each director to be elected will hold office from the date of their election by the stockholders until the third subsequent annual meeting of stockholders or until his or her successor is elected and has been qualified, or until such director’s earlier death, resignation or removal.

The nominees were selected by the Board upon the recommendation of the nominating and corporate governance committee. Each of the nominees has a record of integrity, a strong professional reputation and a record of entrepreneurial or managerial achievement. The specific experience, qualifications, attributes and skills of each nominee that led the Board to conclude that the individual should serve as a director are described in each nominee’s biography below.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the fourthree nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. Directors are elected by a plurality of the votes of the shares present in person or by proxy at the meeting and entitled to vote on the election of directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR” THE ELECTION OF EACH NAMED NOMINEE.

The following table sets forth, for the Class IIIII nominees and our other current directors who will continue in office after the Annual Meeting, information with respect to their ages as of the date hereof and position/office held with the Company:

Name | Age | Position/Office Held With the Company | Director Since | |||

| Class II Directors whose terms expire at the 2013 Annual Meeting of Stockholders | ||||||

| John W. Biddinger(1) | 72 | Director | 2006 | |||

| Angela R. Hicks Bowman | 40 | Chief Marketing Officer and Director | 2013 | |||

| Steven M. Kapner(2) | 47 | Director | 2008 | |||

| Keith J. Krach(3) | 55 | Chairman of the Board | 2011 | |||

| Class III Directors whose terms expire at the 2014 Annual Meeting of Stockholders | ||||||

| Mark Britto(2)(3) | 48 | Director | 2011 | |||

| Michael S. Maurer(1) | 70 | Director | 2012 | |||

| Susan E. Thronson (1) | 51 | Director | 2012 | |||

| Class I Directors for election at the 2015 Annual Meeting of Stockholders | ||||||

| William S. Oesterle | 47 | Chief Executive Officer and Director | 1995 | |||

| John H. Chuang(3) | 47 | Director | 1996 | |||

| Roger H. Lee(2) | 41 | Director | 2008 | |||

(1) Member of the Audit Committee of the Board.

(2) Member of the Compensation Committee of the Board.

Name Age Position/Office Held With the Company Director Since Class III Directors whose terms expire at the 2014 Annual Meeting of Stockholders Mark Britto(2)(3) 49 Director 2011 Michael S. Maurer(1)(3) 71 Director 2012 Susan E. Thronson(1) 52 Director 2012 Class I Directors for election at the 2015 Annual Meeting of Stockholders William S. Oesterle 48 Chief Executive Officer and Director 1995 John H. Chuang 48 Director 1996 Roger H. Lee(2) 42 Director 2008 Class II Directors whose terms expire at the 2016 Annual Meeting of Stockholders John W. Biddinger(1) 73 Director 2006 Angela R. Hicks Bowman 41 Chief Marketing Officer and Director 2013 Steven M. Kapner(2) 48 Director 2008 Keith J. Krach(3) 56 Chairman of the Board 2011

| (1) Member of the Audit Committee of the Board. |

| (2) Member of the Compensation Committee of the Board. |

| (3) Member of the Nominating and Corporate Governance Committee of the Board. |

Set forth below is biographical information for the nominees and each person whose term of office as a director will continue after the Annual Meeting. The following includes certain information regarding our directors’ individual experience, qualifications, attributes and skills that led the Board to conclude that they should serve as directors.

Nominees for Election to a Three-Year Term Expiring at the 20162017 Annual Meeting of Stockholders

John W. Biddinger has served on our Board since April 2006. Mr. Biddinger has served on the board of directors at City Financial Corporation, an Indianapolis-based investment banking firm, since 1981, and has served as Managing Director of City Investment Group, LLC since July 2005. Mr. Biddinger currently serves on the boards of directors of a number of privately-held companies. Mr. Biddinger joined City Securities Corporation in 1963 and held various securities-related positions before becoming President in 1979, a position that he held until 1980. Mr. Biddinger was also President of Biddinger Investment Capital Corporation, a leveraged buy-out firm, from 1981 to 1999. Mr. Biddinger holds a Bachelor of Science in Business from Indiana University. We believe Mr. Biddinger is qualified to serve on our Board due to his extensive investment and securities experience as well as his experience serving on the boards of other companies.

Angela R. Hicks Bowman, who goes by Angie Hicks, is our co-founder and has served as our Chief Marketing Officer since May 2000 and has served on our Board since March 2013. As the sole employee in June 1995, Ms. Hicks Bowman started what would become Angie’s List in Columbus, Ohio, serving as President from our inception in June 1995 until December 1998. She took a leave of absence from her position as President from

December 1998 to May 2000 to pursue a Master of Business Administration. Ms. Hicks Bowman holds a Bachelor of Arts in Economics from DePauw University and a Master of Business Administration from Harvard Business School. We believe Ms. Hicks Bowman is qualified to serve on our Board due to the leadership and operational experience she brings as our Chief Marketing Officer, the historical knowledge and continuity she brings as our co-founder and her unique perspective as the public face of the Company.

Steven M. Kapner has served on our Board since April 2008. Mr. Kapner currently serves as Managing Director of Aquent LLC, a leading marketing staffing firm, which he co-founded in 1986. At Aquent he has held various positions including Chief Financial Officer, General Manager of an internal technology start-up, and President of two operating divisions. He currently runs Aquent’s operations in Japan. Mr. Kapner also serves as Chairman of The Aspire Group, Aquent’s staffing business for security-cleared personnel. He has managed venture capital investments for Harvard University’s endowment fund and worked as a strategy consultant for the Boston Consulting Group. Mr. Kapner holds a Bachelor of Arts in History and a Master of Business Administration, both from Harvard University. We believe Mr. Kapner is qualified to serve on our Board due to his deep operating and leadership experience, his financial management experience as Aquent’s Chief Financial Officer and his global perspective.

Keith J. Krachhas served on our Board as Chairman since April 2011. Mr. Krach currently serves as Chief Executive Officer, President and Chairman of the Board of DocuSign Inc., an electronic signature network company, positions which he has held since July 2003 and August 2011, respectively. He also holds the position of Chairman of the Purdue University Board of Trustees. Since 2003, Mr. Krach has been Chief Executive Officer of 3Points, Inc., an investment holding company. In 1996, Mr. Krach co-founded Ariba, Inc., a provider of collaborative business commerce solutions for buying and selling goods and services, serving as Chief Executive Officer and Chairman of the Board from October 1996 until July 2003. Prior to founding Ariba, Mr. Krach joined the founding team and served as the Chief Operating Officer at Rasna Corporation, a developer and marketer of mechanical design and analysis software, which was sold in 1995 to Parametric Technologies. Mr. Krach began his career at General Motors, where he led GM’s first-ever Japanese joint venture, GMF Robotics, and was GM’s youngest-ever vice president. Mr. Krach holds a Bachelor of Science in Industrial Engineering from Purdue University and a Master of Business Administration from Harvard Business School. We believe Mr. Krach is qualified to serve on our Board due to his extensive operational, senior management and board experience with technology companies.

Directors Continuing in Office Until the 2014 Annual Meeting of Stockholders

Mark Britto has served on our Board since September 2011. Mr. Britto currently serves as President and Chief Executive Officer of Boku, Inc., a mobile online payments company, a position he has held since January 2009. He also currently serves on the boards of directors of a number of privately-held technology companies. Prior to joining Boku, Inc., Mr. Britto served as President and Chief Executive Officer of Ingenio Inc., a service marketplace and performance advertising company acquired by AT&T Inc. in 2007, from July 2002 to December 2008. In 1998, Mr. Britto co-founded Accept.com Financial Services Corporation, an online payments company that was acquired by Amazon.com, Inc., an e-commerce company, in June 1999. From June 1999 until June 2002, Mr. Britto served as Senior Vice President, Worldwide Services and Sales, at Amazon.com. Mr. Britto began his career in senior credit and risk management roles at First USA and NationsBank, N.A. Mr. Britto holds a Bachelor of Science in Industrial Engineering and Operations Research and a Masters of Science in Industrial Engineering and Operations Research, both from the University of California, Berkeley. We believe that Mr. Britto is qualified to serve on our Board due to his experience as Chief Executive Officer of technology companies, including an online payment company, and his perspective as a Silicon Valley technology entrepreneur.

Michael S. Maurer has served on our Board since February 2012. Mr. Maurer has served as Chairman of the Board of The National Bank of Indianapolis Corporation, a financial institution he founded in 1993, and its wholly-owned subsidiary, The National Bank of Indianapolis, since 1993. He also has served as Chairman of the Board of IBJ Corp., a publishing company which ownsThe Indianapolis Business Journal, since 1990, where he also served as Chief Executive Officer from 1990 to 2012.2014. Since 2013, Mr. Maurer has served as Chairman of the Board of Arcamed, LLC. Also since 2013, Mr. Maurer has served as a Board of Director for Home Health Depot. Mr. Maurer served as President of the Indiana

Economic Development Corporation from 2005 to 2006 and also served as Indiana Secretary of Commerce in 2006. From 1991 to 1992, he served as a director and member of the Executive Committee of Merchants National Bank/National City Bank, Indianapolis, Indiana, a financial institution. Mr. Maurer was self-employed as an attorney from 1969 to 1988. Mr. Maurer holds a Bachelors of Science in accounting from the University of Colorado and a Juris Doctor degree from the Indiana University Maurer School of Law. He successfully completed the CPA examination. We believe that Mr. Maurer is qualified to serve on our Board due to his financial experience as well as his extensive leadership experience serving on the boards of other companies.

Susan E. Thronson has served on our Board since November 2012. Ms. Thronson currently servesserved as Senior Vice President, Global Marketing, at Marriott International, Inc., a worldwide operator, franchisor and licensor of hotels and corporate housing properties, a position she has held sincefrom July 2005.2005 to July 2013. At Marriott, Ms. Thronson has held a variety of marketing management positions, most recently asincluding Senior Vice President, International Marketing, International Lodging Organization, from January 1997 to June 2005. Prior to joining Marriott, Ms. Thronson served as an Account Supervisor at McCann-Erickson Worldwide. Ms. Thronson holds a Bachelor of Arts in Journalism from the University of Nevada-Reno. We believe that Ms. Thronson is qualified to serve on our board of directors due to her extensive global and brand marketing expertise as well as her leadership experience working with global operations.

Directors Continuing in Office Until the 2015 Annual Meeting of Stockholders

William S. Oesterle, our co-founder, has served as our Chief Executive Officer since January 1999 and has served on our Board since our inception in June 1995. Since 2007, Mr. Oesterle has served on the board of directors of The National Bank of Indianapolis Corporation. He also took on additional outside responsibilities from July 2003 until December 2004 when he managed the political campaign of Indiana Governor Mitch Daniels. Prior to joining us, Mr. Oesterle was a partner with CID Equity Partners, a Midwest-based venture capital firm from January 1994 to December 1998. Mr. Oesterle holds a Bachelor of Science in Economics from Purdue University and a Master of Business Administration from Harvard Business School. We believe Mr. Oesterle is qualified to serve on our Board due to the perspective, leadership and operational experience he brings as our Chief Executive Officer as well as the historical knowledge and continuity he brings as our co-founder.

John H. Chuang has served on our Board since April 1996. Mr. Chuang co-founded, and since 1986 has served as Chief Executive Officer of, Aquent LLC, a leading marketing staffing firm. Mr. Chuang holds a Bachelor of Arts in Economics and a Master of Business Administration, both from Harvard University. We believe Mr. Chuang is qualified to serve on our Board due to his leadership and business development experience, his broad understanding of the operational, financial and strategic issues facing growing companies and the perspective he brings as an affiliate of our largest stockholder.

Roger H. Lee has served on our Board since April 2008. Mr. Lee is affiliated with Battery Ventures, a venture capital firm, where he focuses on consumer, internet and digital media markets. Mr. Lee joined Battery Ventures in December 2001 and has been a managing member of the general partners of various investment funds affiliated with Battery Ventures. He currently serves on the boards of directors of a number of privately-held technology companies. Prior to joining Battery Ventures, Mr. Lee spent ten years as an entrepreneur and operator and most recently was the co-founder of Corio, a managed services provider that was acquired by IBM, where he oversaw all business development activities and later became a General Manager. Mr. Lee holds a Bachelor of Arts in Political Science from Yale University. We believe that Mr. Lee is qualified to serve on our Board due to his experience with a wide variety of internet and technology companies.

Directors Continuing in Office Until the 2016 Annual Meeting of Stockholders

John W. Biddinger has served on our Board since April 2006. Mr. Biddinger has served on the board of directors at City Financial Corporation, an Indianapolis-based investment banking firm, since 1981 and has served as Managing Director of City Investment Group, LLC since July 2005. Mr. Biddinger currently serves on the boards of directors of a number of privately-held companies. Mr. Biddinger joined City Securities Corporation in 1963 and held various securities-related positions before becoming President in 1979, a position that he held until 1980. Mr. Biddinger was also President of Biddinger Investment Capital Corporation, a leveraged buy-out firm, from 1981 to 1999. Mr. Biddinger holds a Bachelor of Science in Business from Indiana University. We believe Mr. Biddinger is qualified to serve on our Board due to his extensive investment and securities experience as well as his experience serving on the boards of other companies.

Angela R. Hicks Bowman, who goes by Angie Hicks, is our co-founder, has served as our Chief Marketing Officer since May 2000 and has served on our Board since March 2013. As the sole employee in June 1995, Ms. Hicks Bowman started what would become Angie’s List in Columbus, Ohio, serving as President from our inception in June 1995 until December 1998. She took a leave of absence from her position as President from December 1998 to May 2000 to pursue a Master of Business Administration. Ms. Hicks Bowman holds a Bachelor of Arts in Economics from DePauw University and a Master of Business Administration from Harvard Business School. We believe Ms. Hicks Bowman is qualified to serve on our Board due to the leadership and operational experience she brings as our Chief Marketing Officer, the historical knowledge and continuity she brings as our co-founder and her unique perspective as the public face of the Company.

Steven M. Kapner has served on our Board since April 2008. Mr. Kapner currently serves as Managing Director of Aquent LLC, a leading marketing staffing firm, which he co-founded in 1986. At Aquent, he has held various positions, including Chief Financial Officer, General Manager of an internal technology start-up, and President of two operating divisions. He currently runs Aquent’s operations in Japan. He has managed venture capital investments for Harvard University’s endowment fund and worked as a strategy consultant for the Boston Consulting Group. Mr. Kapner holds a Bachelor of Arts in History and a Master of Business Administration, both from Harvard University. We believe Mr. Kapner is qualified to serve on our Board due to his deep operating and leadership experience, his financial management experience as Aquent’s Chief Financial Officer and his global perspective.

Keith J. Krachhas served on our Board as Chairman since April 2011. Mr. Krach currently serves as Chief Executive Officer, President and Chairman of the Board of DocuSign Inc., an electronic signature network company, positions which he has held since July 2003 and August 2011, respectively. He held the position of Chairman of the Purdue University Board of Trustees from 2009 until July, 2013. Since 2003, Mr. Krach has been Chief Executive Officer of 3Points, Inc., an investment holding company. In 1996, Mr. Krach co-founded Ariba, Inc., a provider of collaborative business commerce solutions for buying and selling goods and services, serving as Chief Executive Officer and Chairman of the Board from October 1996 until July 2003. Prior to founding Ariba, Mr. Krach joined the founding team and served as the Chief Operating Officer at Rasna Corporation, a developer and marketer of mechanical design and analysis software, which was sold in 1995 to Parametric Technologies. Mr. Krach began his career at General Motors, where he led GM’s first-ever Japanese joint venture, GMF Robotics, and was GM’s youngest-ever vice president. Mr. Krach holds a Bachelor of Science in Industrial Engineering from Purdue University and a Master of Business Administration from Harvard Business School. We believe Mr. Krach is qualified to serve on our Board due to his extensive operational, senior management and board experience with technology companies.

On March 17, 2014, the Company announced Mr. Krach’s retirement from Angie’s List Board of Directors, which will be effective at the annual meeting of stockholders in May.

EXECUTIVEOFFICERS

Our executive officers (other than Mr. Oesterle and Ms. Hicks Bowman) and their ages as of the date hereof and positions are as follows:

Name | Age | Position | ||

Thomas R. Fox | 39 | Chief Financial Officer | ||

J. Mark Howell | 49 | Chief Operating Officer | ||

Robert | 55 | Chief Technology Officer | ||

Patrick D. Brady | 58 | President, Marketplace | ||

Michael D. Rutz | 39 | Executive Vice President of Sales | ||

Shannon M. Shaw | 39 | Executive Vice President, General Counsel & Corporate Secretary | ||

RobertThomas R. MillardFox has served as our Chief Financial Officer since May 2011.September 2013. Mr. Fox most recently served at NOKIA, a global leader in mobile communications, as Senior Director, Business Planning and Operations, where he was responsible for developing product-level profitability models to guide investment decision-making. Prior to joining us, he served from October 1998 to April 2011 as Chief Financial OfficerNOKIA in 2012, Mr. Fox worked for NAVTEQ Corporation, a leading provider of FinishMaster, Inc., an Indianapolis-basedcomprehensive digital map information, which was acquired by NOKIA in 2008. Mr. Fox held various executive and formerly publicly-traded national distributor of automotive paints, coatings and paint-related accessories. From February 1996 to September 1998, Mr. Millard served as Chief Financial Officer at Personnel Management, Inc., a publicly-traded industrial staffing company. Mr. Millard is a Certified Public Accountant and previously has held leadershipmanagerial positions at Lacy Diversified Industries, Ltd.NAVTEQ beginning in 2002, including Vice President of Product Management, Vice President of Sales Strategy and Callahan Enterprises, Inc.Operations, Director of Investor Relations, and Manager of Corporate Finance and Business Planning. Before joining NAVTEQ, Mr. Millard began his financial careerFox was a research analyst for Lincoln Capital Management Company, and before that, he was an analyst with positions at Arthur Andersen & Co. and Ernst & Young LLP.the investment banking division of Credit Suisse. Mr. MillardFox holds a Bachelor of MusicBusiness Administration in Music BusinessFinance and Economics from DePauwthe University of Notre Dame and a Master of Business Administration from Indianathe Kellogg School of Management at Northwestern University.

J. Mark Howell has served as our Chief Operating Officer since March 2013. Prior to joining us, Mr. Howell served at Ingram Micro, Inc., a wholesale provider of technology products and supply chain services, as President of Ingram Micro North America Mobility, where he was responsible for managing the company’s mobility operations and activities in the United States and Canada. Prior to joining Ingram Micro in the fall of 2012 when Ingram acquired BrightPoint, Inc., a distributor of mobile devices for phone companies, Mr. Howell had held various executive positions at BrightPoint since 1994, including President, BrightPoint Americas;Americas, President and Chief Operating Officer;Officer, and Executive Vice President and Chief Financial Officer. Before joining BrightPoint, he held the position of Corporate Controller for ADESA Corporation, and before that, he was an accountant with Ernst & Young LLP. Mr. Howell holds a Bachelor of Business Administration from the University of Notre Dame.

Manu ThaparRobert Wiseman has served as our Chief Technology Officer since October 2011.March 2014. Prior to joining us, Mr. ThaparWiseman was Chief Technology Officer of Sabre Holdings Corporation, a global travel and tourism technology solutions provider, from May 2006 to March 2014, where he was responsible for all application and infrastructure technology, IT security and engineering across Sabre’s three brands. Prior to that, Mr. Wiseman held various positions at several technology and travel companies, including Cendant, Orbitz, Inc., Fairair.com and Delta Air Lines, Inc. Mr. Wiseman attended CDI Technical College, Leeds, England where he studied Computer Operations.

Patrick D. Brady has served from January 2010 to October 2011 as Viceour President of Engineering of Wal-Mart.com, an e-commerce website. From September 2008Marketplace since May 2013. Prior to October 2009,joining us, he served as Senior ViceChief Executive Officer of Stoneacre Partners LLC, an operating platform focused on securing, creating, building and managing businesses that seek to monetize consumer affinity and brand relationships, from its formation in 2002. From 1989 to 2001, Mr. Brady served in several roles over the years including President, Chief Operating Officer, Chief Financial Officer, and Chief Executive Officer of Engineering for Myspace, a social networking site. From October 2005 to August 2008, he served as Vice President of Engineering for Yahoo!,Cyrk, Inc., a digital mediaan affinity and loyalty marketing company. Prior to that, Mr. Thapar served as Senior Director of Engineering for Cisco Systems, Inc., a designer, manufacturer and seller of internet protocol-based networking and other products.Brady held various investment banking positions at commercial banks. Mr. ThaparBrady holds a Bachelor of EngineeringArts degree in Electrical EngineeringGeneral Studies from Punjab UniversityHarvard College and a DoctorMasters of Philosophy degree in Computer SystemsBusiness Administration from Stanford University.Harvard Business School.

Michael D. Rutz has served as our Executive Vice President of Sales since February 2011. He previously served as Director of Account Management in 2006 and was appointed to develop our health care category offerings in 2008. In 2010, he continued to manage Angie’s List Health & Wellness while starting up other projects. Prior to joining us in 2006, Mr. Rutz served as President of Care Ambulance, a private ambulance company. He has also has

served as a key strategist in political and advocacy roles for several political campaigns ranging from mayoral to congressional to statewide contests and held a key role in the campaigns for Indiana Governor Mitch Daniels in 2004 and 2008. Mr. Rutz holds a Bachelor of Science in Public Affairs and a Bachelor of Arts in French, both from Indiana University.

Charles Hundt has served as our Controller since August 2007 and will serve as our interim Chief Financial Officer beginning April 1, 2013. Mr. Hundt also served as our interim principal financial officer from May 2010 to May 2011. He previously served as our Director of Accounting from August 2005 to August 2007. Prior to joining us, Mr. Hundt worked at Katz, Sapper & Miller, a regional accounting firm, most recently as Manager, from August 1997 to August 2005. Mr. Hundt holds a Bachelor of Science degree and a Master of Accountancy degree, both from Manchester College.

Shannon M. Shaw has served as our Vice President and General Counsel since September 2011 and our Corporate Secretary since March 2012. Prior to joining us, Ms. Shaw was a labor and employment attorney, most recently as Of Counsel, at Barnes & Thornburg, LLP, a law firm, from September 2003 to September 2011, where she litigated on behalf of companies and advised national and local companies on compliance with federal and state labor and employment laws. Ms. Shaw served as Media Relations Coordinator at Clarian Health Partners, a large hospital conglomerate, from 1997 to 2000, where she worked in media and public relations. Ms. Shaw holds Bachelors of Arts in both journalism and political science from Indiana University and a Juris Doctor from Indiana University School of Law.

INFORMATIONREGARDING THE BOARD OF DIRECTORS AND ITS COMMITTEES

Our business and affairs are managed under the direction of the Board. The current members of the Board are John W. Biddinger, Mark Britto, John H. Chuang, Angela R. Hicks Bowman, Steven M. Kapner, Keith J. Krach, Roger H. Lee, Michael S. Maurer, William S. Oesterle and Susan E. Thronson.

The Board is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Our directors are divided among the three classes as follows:

the Class I directors are Messrs. Chuang, Lee and Oesterle, and their terms will expire at the annual general meeting of stockholders to be held in 2015;

• | the Class I directors are Messrs. Chuang, Lee and Oesterle, and their terms will expire at the annual general meeting of stockholders to be held in 2015; |

the Class II directors are Ms. Hicks Bowman and Messrs. Biddinger, Kapner and Krach, and their terms will expire at the annual general meeting of stockholders to be held in 2013; and

• | the Class II directors are Ms. Hicks Bowman and Messrs. Biddinger, Kapner and Krach, and their terms will expire at the annual general meeting of stockholders to be held in 2016; and |

• | the Class III directors are Messrs. Britto and Maurer and Ms. Thronson, and their terms will expire at the annual general meeting of stockholders to be held in 2014. |

the Class III directors are Messrs. Britto and Maurer and Ms. Thronson, and their terms will expire at the annual general meeting of stockholders to be held in 2014.

Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors.

BoardBoard Responsibilities and Risk Oversight

Our Board is responsible for, among other things, overseeing the conduct of our business;business, reviewing and, where appropriate, approving our major financial objectives, plans and actions;actions, and reviewing the performance of the Chief Executive Officer and other members of management based on reports from the compensation committee of the Board. Following the end of each fiscal year, the Board conducts an annual self-evaluation, which includes a review of any areas in which the Board or management believes the Board can make a better contribution to our governance, as well as a review of the committee structure and an assessment of the Board’s compliance with the principles set forth in our corporate governance guidelines. In fulfilling the Board’s responsibilities, directors have full access to our management and independent advisors.

Generally, various committees of the Board oversee risks associated with their respective areas of responsibility and expertise. The audit committee of the Board discusses with management our policies with respect to risk assessment and management;management, our significant financial risk exposures and the actions management has taken to limit, monitor or control such exposures. In addition, the compensation committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation programs. The nominating and corporate governance committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with our overall governance practices and the leadership structure of the Board (as further described under “Board Leadership”). The Board is kept informed of each committee’s risk oversights and other activities via regular reports of the committee chairs to the full Board.

We are focused on our corporate governance practices and value independent Board oversight as an essential component of strong corporate performance to enhance stockholder value. Our commitment to independent oversight is demonstrated by the fact that all of our directors, except William S. Oesterle, our Chief Executive Officer, and Angela R. Hicks Bowman, our Chief Marketing Officer, are “independent” as defined under the NASDAQ listing standards. Our Board acts independently of management and regularly holds independent director sessions of the Board without members of management present.

Our corporate governance guidelines provide that one of our independent directors should serve as a lead independent director at any time when the Chief Executive Officer serves as the Chairman of the Board, or if the Chairman of the Board is not otherwise independent. The lead independent director would preside over periodic meetings of our independent directors, serve as a liaison between our Chairman and the independent directors and perform such additional duties as our Board may otherwise determine and delegate. BecauseAs our Board has determined that Mr. Krach, the Chairman of the Board, is an independent director, our Board has not appointed a lead independent director. Our Board believes that the current board leadership structure is best for the Company and its stockholders at this time.

Our Board has the following standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Under our corporate governance guidelines, committee members are appointed by our Board based on the recommendation of the nominating and corporate governance committee, except that members of the nominating and corporate governance committee are appointed by the independent members of the Board. Members serve on these committees until their resignation or until otherwise determined by our Board. Our Board may establish other committees to facilitate the management of our business.

Audit Committee

The primary functions of the audit committee are:

overseeing management’s maintenance of the reliability and integrity of our accounting policies and financial reporting and our disclosure practices;

• | overseeing management’s maintenance of the reliability and integrity of our accounting policies and financial reporting and our disclosure practices; |

overseeing management’s establishment and maintenance of processes to assure that an adequate system of internal control is functioning;

• | overseeing management’s establishment and maintenance of processes to assure that an adequate system of internal control is functioning; |

reviewing our annual and quarterly financial statements prior to their filing;

• | reviewing our annual and quarterly financial statements prior to their filing; |

serving as a qualified legal compliance committee to review reports and violations of law; and

• | serving as a qualified legal compliance committee to review reports and violations of law; and |

• | appointing and evaluating the independent registered public accounting firm and considering and approving any non-audit services proposed to be performed by the independent registered public accountants. |

appointing and evaluating the independent registered public accounting firm and considering and approving any non-audit services proposed to be performed by the independent registered public accountants.

A detailed list of the audit committee’s functions is included in its charter which is available in the “Corporate Governance” section of our “Investor Relations” website atinvestor.angieslist.com.

The current members of our audit committee are Messrs. Biddinger and Maurer and Ms. Thronson, with Mr. Biddinger serving as the committee’s chair. Messrs. Biddinger and Maurer and Ms. Thronson are “independent” as defined under the NASDAQ listing standards, and all three directors are “independent” as defined under Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Each member of the audit committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and the NASDAQ. Our Board has determined that Mr. Biddinger is an audit committee “financial expert,” as that term is defined by the applicable rules of the SEC. Our audit committee operates under a written charter that satisfies the applicable standards of the SEC and the NASDAQ.

Compensation Committee

The primary functions of the compensation committee are:

• | reviewing key employee compensation policies, plans and programs; |

reviewing key employee compensation policies, plans and programs;

• | determining, or recommending to the Board for determination, the compensation of our Chief Executive Officer and each of our other executive officers; |

• | monitoring performance and compensation of our employee-directors, officers and other key employees; |

• | preparing recommendations and periodic reports to the Board concerning these matters; and | ||

• | reviewing and approving any incentive compensation and equity-based plans and the grants thereunder. |

preparing recommendations and periodic reports to the Board concerning these matters; and

reviewing and approving any incentive compensation and equity-based plans and the grants thereunder.

A detailed list of the compensation committee’s functions is included in its charter which is available in the “Corporate Governance” section of our “Investor Relations” website atinvestor.angieslist.com.

The members of our compensation committee are Messrs. Britto, Kapner and Lee, with Mr. Britto serving as the committee’s chair. Messrs. Britto, Kapner and Lee are “independent” as defined under the NASDAQ listing standards. For further information about the compensation committee’s process for determining executive compensation, including the role of the executive officers and the compensation committee’s use of an independent consultant, see the section captioned “Executive Compensation—Compensation Discussion and Analysis” below.

Nominating and Corporate Governance Committee

The primary functions of the nominating and corporate governance committee are:

recommending persons to be selected by the Board as nominees for election as directors and to fill any vacancies on the Board;

• | recommending persons to be selected by the Board as nominees for election as directors and to fill any vacancies on the Board; |

considering and recommending to the Board qualifications for the position of director and policies concerning the term of office of directors and the composition of the Board; and

• | considering and recommending to the Board qualifications for the position of director and policies concerning the term of office of directors and the composition of the Board; and |

• | considering and recommending to the Board other actions relating to corporate governance. |

considering and recommending to the Board other actions relating to corporate governance.

A detailed list of the nominating and corporate governance committee’s functions is included in its charter which is available in the “Corporate Governance” section of our “Investor Relations” website atinvestor.angieslist.com.

The members of our nominating and corporate governance committee are Messrs. Britto, ChuangMaurer and Krach, with Mr. Krach serving as the committee’s chair. Messrs. Britto, ChuangMaurer and Krach are “independent” as defined under the NASDAQ listing standards.

In recommending candidates for election to the Board, the independent members of the nominating and corporate governance committee consider various criteria, including a candidate’s relevant business skills and experiences, personal and professional integrity, ethics and values;values, experience in corporate management, including serving as an officer or former officer of a publicly heldpublicly-held company, and experience as a board member of another publicly heldpublicly-held company. The Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

Candidates are identified through a variety of sources, including current and past members of the Board, our officers, individuals personally known by the members of the Board and research. The nominating and corporate governance committee will consider director candidates recommended by stockholders when the recommendations are properly submitted. For a stockholder to make a nomination for election to the Board at an annual meeting, the stockholder must provide notice to us, which notice must be delivered to, or mailed and received at, our principal executive offices not less than 90 days and not more than 120 days prior to the one-year anniversary of the preceding year’s annual meeting;meeting, provided, that if the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, the stockholder’s notice must be delivered, or

mailed and received, no earlier than 120 days and no later than 70 days prior to the date of the annual meeting or the 10th day following the date on which public disclosure of the date of such annual meeting is made. Further updates and supplements to such notice may be required at the times and in the forms required under our bylaws. As set forth in our bylaws, submissions must include for each person whom the stockholder proposes to nominate for election as a director all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, including such person’s written consent to be being named in the proxy statement as a nominee and to serving as a director if elected. Our bylaws also specify further requirements as to the form and content of a stockholder’s notice. We recommend that any stockholder wishing to make a nomination for director review a copy of our bylaws, as amended and restated to date, a copy of which is available, without charge, from our Secretary at 1030 E. Washington Street, Indianapolis, Indiana 46202.

MeetingsMeetings of the Board of Directors, Board and Committee Member Attendance and Annual Meeting Attendance

Our Board met eightsix times during the last fiscal year. The audit committee of the Board met eighttwelve times, the compensation committee of the Board met sevenfive times, and the nominating and corporate governance committee of the Board met fivethree times during the last fiscal year. During 2012,2013, each Board member except for Mr. Maurer, attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he or she served. Mr. Maurer attended approximately 70% of the aggregate of the meetings of the Board and Audit Committee. We encourage all of our directors and nominees for director to attend our annual meeting of stockholders; however, attendance is not mandatory. All of our directors attended our 20122013 Annual Meeting of Stockholders.

StockholderStockholder Communications with the Board of Directors

Should stockholders wish to communicate with the Board or any specified individual directors, such correspondence should be sent to the attention of the Company’s Secretary, at 1030 E. Washington Street, Indianapolis, Indiana 46202. The Company’s Secretary will forward the communication to the Board members.

CompensationCompensation Committee Interlocks and Insider Participation

The members of our compensation committee are Messrs. Britto, Kapner and Lee. None of our executive officers currently serves, or has served during the last completed year, as a member of the board or the compensation committee of any entity that has one or more executive officers serving as a member of our Board or compensation committee.

IndependenceIndependence of the Board of Directors

As required under the NASDAQ Stock Market rules and regulations, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the Board. The Board consults with our counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in the NASDAQ listing standards, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board has affirmatively determined that all of our directors are independent directors within the meaning of the applicable NASDAQ listing standards, except for Mr. Oesterle, our current Chief Executive Officer, and Ms. Hicks Bowman, our current Chief Marketing Officer.

As required under the NASDAQ Stock Market rules and regulations, our independent directors meet in independent director sessions at which only independent directors are present. All of the committees of our Board are comprised entirely of directors determined by the Board to be independent within the meaning of the NASDAQ Stock Market rules and regulations.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

The audit committee of our Board has engaged Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013,2014 and is seeking ratification of such appointment by our stockholders at the Annual Meeting. Ernst & Young LLP has audited our financial statements since the fiscal year endingended December 31, 2008. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our bylaws nor other governing documents or law require stockholder ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm. However, the audit committee is submitting the appointment of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the appointment, the audit committee will reconsider whether or not to retain Ernst & Young LLP. Even if the appointment is ratified, the audit committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and our stockholders.

To be approved, the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm must receive a “For” vote from the holders of a majority of the outstanding shares of common stock present in person or represented by proxy and entitled to vote on the proposal. Abstentions and broker non-votes will be counted towards a quorum. Abstentions will have the same effect as an “Against” vote for purposes of determining whether this matter has been approved. Broker non-votes will not be counted for any purpose in determining whether this matter has been approved.

Principal Accountant Fees and Services

The audit committee approved all audit services provided by Ernst & Young LLP during the 20122013 and 20112012 fiscal years. The total fees paid or payable to Ernst & Young LLP for the last two fiscal years are as follows:

Type of Fees | Fiscal 2012 | Fiscal 2011 | Fiscal 2013 | Fiscal 2012 | ||||||||||||

Audit Fees | $ | 571,600 | $ | 1,048,965 | $ | 471,800 | $ | 571,600 | ||||||||

Audit-Related Services | — | 45,600 | ||||||||||||||

Audit-Related Fees | — | — | ||||||||||||||

Tax Fees | — | — | — | — | ||||||||||||

All Other Fees | — | — | 20,000 | — | ||||||||||||

|

| |||||||||||||||

Total Fees | $ | 571,600 | $ | 1,094,565 | $ | 491,800 | $ | 571,600 | ||||||||

|

| |||||||||||||||

Audit Fees

This category includes fees during the 20122013 and 20112012 fiscal years incurred for the audits of our annual consolidated financial statements and the reviews of each of the quarterly consolidated financial statements, services rendered in connection with our Form S-1 and Form S-8, related to our initial public and follow-on offerings, comfort letter, consents and other matters related to the SEC.SEC, our current year acquisition of SmartHabitat, Inc. (“BrightNest”), and assessment of the impact of change management in our general IT controls.

Audit-Related Fees

This category includes fees associated with procedures related to quantifying the company’s sales and use tax expense exposures.

Tax Fees

For the fiscal years ended December 31, 2013 and 2012, there were no fees billed by Ernst & Young LLP for audit-related fees.

Tax Fees

For the fiscal years ended December 31, 2013 and 2011,2012, there were no fees billed by Ernst & Young LLP for tax fees.

All Other Fees

This category includes fees associated with procedures performed with respect to a Section 382 tax study. For the fiscal yearsyear ended December 31, 2012, and 2011, there were no fees billed by Ernst & Young LLP for any other professional services.

Pre-Approval Policies and Procedures

The audit committee pre-approves all audit and non-audit services provided by its independent registered public accounting firm. The audit committee annually reviews the audit and permissible non-audit services performed by its independent registered public accounting firm and reviews and approves the fees charged by such accounting firm. This policy is set forth in our company’sCompany’s charter of the audit committee and available on our website.

The audit committee considered whether the non-audit services rendered by Ernst & Young LLP were compatible with maintaining Ernst & Young LLP’s independence as the independent registered public accounting firm of our consolidated financial statements and concluded that they were.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE

APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2013.2014.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required by the SEC’s proxy rules, the Company is providing stockholders with the opportunity to cast an advisory (non-binding) vote on compensation programs for our named executive officers (sometimes referred to as “say on pay”). Accordingly, you may vote on the following resolution at the Annual Meeting:

“Resolved, that the stockholders approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the Compensation Discussion and Analysis, the accompanying compensation tables and the related narrative disclosure in this Proxy Statement.”

To be approved, this proposal must receive a “For” vote from the holders of a majority of the shares of common stock present in person or represented by proxy and entitled to vote on the proposal. Although this advisory vote on executive compensation is nonbinding, the Board and the compensation committee, which is comprised of independent directors, expect to take into account the outcome of the vote when considering future executive compensation decisions to the extent they can determine the cause or causes of any significant negative voting results.

As described in detail under the section captioned “Executive Compensation—Compensation Discussion and Analysis,” our compensation programs are designed to motivate our executives to create a successful company. We believe that our compensation program, with its balance of short-term incentives (including base salary and performance bonuses) and long-term incentives (including equity awards) reward sustained performance that is aligned with long-term stockholder interests. Stockholders are encouraged to read the Compensation Discussion and Analysis, the accompanying compensation tables and the related narrative disclosure.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL, ON AN

ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS

DISCLOSED IN THE COMPENSATION DISCUSSION AND ANALYSIS, THE ACCOMPANYING

COMPENSATION TABLES AND THE RELATED NARRATIVE DISCLOSURE.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTSecurityOwnership of Certain Beneficial Owners and Management

The following table presents information as to the beneficial ownership of our common stock as of February 15, 201314, 2014 for:

each person, or group of affiliated persons, known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock;

each director and nominee for director;

each named executive officer as set forth in the Summary Compensation Table below; and

all directors and current executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Shares of our common stock subject to options that are currently exercisable or exercisable within 60 days of February 15, 2013,14, 2014, are deemed to be outstanding and to be beneficially owned by the person holding the options for the purpose of computing the percentage ownership of that person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Percentage ownership of our common stock in the table is based on 57,944,18658,495,845 shares of our common stock issued and outstanding on February 15, 2013.14, 2014. Unless otherwise indicated, the address of each of the individuals and entities named below is c/o Angie’s List, Inc., 1030 E. Washington Street, Indianapolis, Indiana, 46202.

| Shares of Common Stock Beneficially Owned(1) | ||||||||

Name of Beneficial Owner | Number of Shares Beneficially Owned | Percent | ||||||

Greater than 5% Stockholder: | ||||||||

TRI Investments, LLC(2) | 11,618,769 | 20.1 | % | |||||

T. Rowe Price Associates, Inc.(3) | 9,039,560 | 15.6 | % | |||||

Capital Research Global Investors(4) | 3,313,470 | 5.7 | % | |||||

Lord, Abbett and Co, LLC(5) | 3,014,605 | 5.2 | % | |||||

Directors and Named Executive Officers: | ||||||||

William S. Oesterle(6) | 3,171,869 | 5.5 | % | |||||

Robert R. Millard(7) | 127,050 | * | ||||||

Manu Thapar(8) | 63,870 | * | ||||||

Michael D. Rutz(9) | 26,800 | * | ||||||

Angela R. Hicks Bowman | 807,216 | 1.4 | % | |||||

John W. Biddinger(10) | 161,633 | * | ||||||

Mark Britto(11) | 128,588 | * | ||||||

John H. Chuang(2) | 11,626,698 | 20.1 | % | |||||

Steven M. Kapner(2) | 11,626,698 | 20.1 | % | |||||

Keith J. Krach(12) | 254,100 | * | ||||||

Roger H. Lee(13) | 7,929 | * | ||||||

Michael Maurer(14) | 85,861 | * | ||||||

Susan E. Thronson(15) | 5,352 | * | ||||||

Directors and Officers as a Group (15 persons)(16) | 16,474,895 | 28.4 | % | |||||

| Shares of Common Stock Beneficially Owned(1) | |||||

| Name of Beneficial Owner | Number of Shares Beneficially Owned | Percent | |||

| Greater than 5% Stockholder: | |||||

TRI Investments, LLC(2) | 11,618,769 | 19.9 | % | ||

Wellington Management Company, LLP(3) | 8,177,045 | 14.0 | % | ||

FMR LLC(4) | 7,638,053 | 13.1 | % | ||

T. Rowe Price Associates, Inc.(5) | 5,992,836 | 10.2 | % | ||

Eagle Asset Management, Inc.(6) | 3,304,208 | 5.6 | % | ||

JAT Capital Management, L.P.(7) | 3,195,114 | 5.5 | % | ||

Directors and Named Executive Officers: |

| ||||

William S. Oesterle(8) | 2,309,474 | 3.9 | % | ||

Thomas R. Fox(9) | — | * | |||

Robert R. Millard(10) | — | * | |||

Charles Hundt(11) | 51,800 | * | |||

J. Mark Howell(12) | 52,609 | * | |||

Michael D. Rutz(13) | 71,000 | * | |||

Patrick D. Brady | — | * | |||

John W. Biddinger(14) | 199,375 | * | |||

Mark Britto(15) | 136,330 | * | |||

John H. Chuang(2) | 11,634,440 | 19.9 | % | ||

Steven M. Kapner(2) | 11,634,440 | 19.9 | % | ||

Keith J. Krach(16) | 316,150 | * | |||

Roger H. Lee(17) | 15,671 | * | |||

Michael S. Maurer(18) | 87,353 | * | |||

Susan E. Thronson(19) | 13,087 | * | |||

Angela R. Hicks Bowman(20) | 811,380 | 1.4 | % | ||

Directors and Officers as a Group (15 persons)(21) | 15,714,340 | 26.9 | % | ||

* | Represents beneficial ownership of less than one percent (1%) of the outstanding common stock. |

(1) | Shares shown in the table above include shares held in the beneficial owner’s name or jointly with others, or in the name of a bank, nominee or trustee for the beneficial owner’s account. |

(2) | Based on the most recently available Schedule 13G/A filed with the SEC on February |